Rumored Buzz on Personal Loans Canada

Rumored Buzz on Personal Loans Canada

Blog Article

What Does Personal Loans Canada Mean?

Table of ContentsThe Ultimate Guide To Personal Loans CanadaHow Personal Loans Canada can Save You Time, Stress, and Money.Fascination About Personal Loans CanadaNot known Facts About Personal Loans CanadaNot known Factual Statements About Personal Loans Canada See This Report on Personal Loans CanadaThe Best Strategy To Use For Personal Loans Canada

There could be limitations based on your credit rating or history. Make sure the loan provider supplies lendings for at the very least as much money as you require, and look to see if there's a minimum finance quantity. Nonetheless, recognize that you might not get approved for as big of a financing as you want.Variable-rate loans often tend to start with a reduced interest price, but the price (and your repayments) could climb in the future. If you want assurance, a fixed-rate car loan might be best. Look for on the internet testimonials and comparisons of lending institutions to find out about various other borrowers' experiences and see which loan providers can be a good fit based on your credit reliability.

This can generally be done over the phone, or in-person, or online. Depending upon the credit history racking up version the lender utilizes, several tough questions that occur within a 14-day (often approximately a 45-day) home window could only count as one hard query for credit history purposes. Furthermore, the scoring model may neglect inquiries from the previous 30 days.

Personal Loans Canada for Beginners

If you get approved for a funding, checked out the fine print. Check the APR and any kind of various other charges and penalties - Personal Loans Canada. You should have a complete understanding of the terms prior to agreeing to them. Once you approve a finance offer, numerous lenders can move the cash directly to your bank account.

Individual car loans can be made complex, and discovering one with a good APR that suits you and your spending plan takes time. Before taking out an individual lending, make certain that you will certainly have the ability to make the regular monthly payments on time. Personal financings are a quick method to obtain money from a bank and various other economic institutionsbut you have to pay the money back (plus rate of interest) over time.

Facts About Personal Loans Canada Revealed

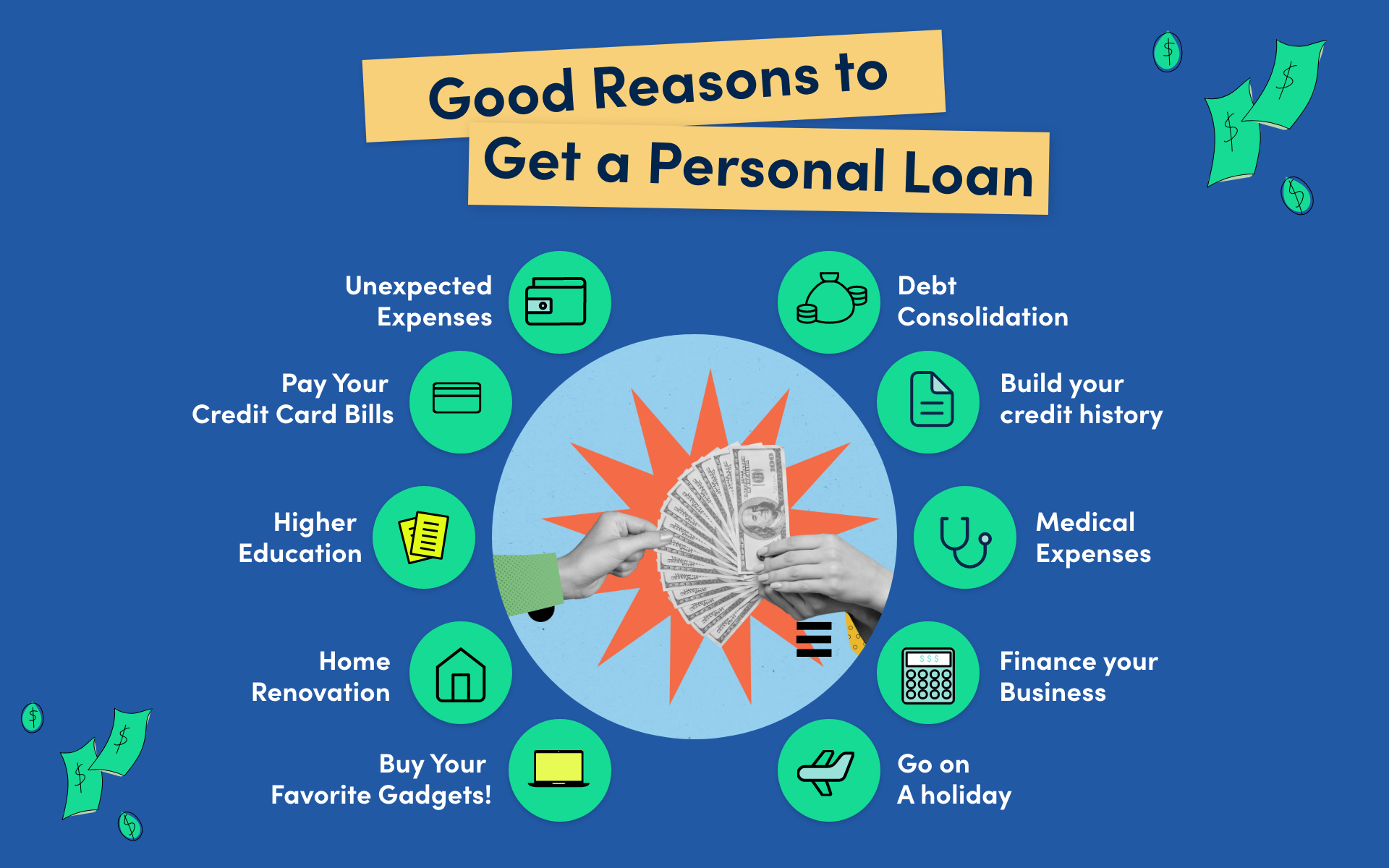

Let's study what an individual financing actually is (and what it's not), the reasons people use them, and how you can cover those crazy emergency expenses without taking on the burden of debt. A personal funding is a swelling amount of money you can borrow for. well, practically anything.

That does not include borrowing $1,000 from your Uncle John to help you spend for Xmas provides or letting your flatmate area you for a couple months' rent. You should not do either of those points (for a variety of factors), yet that's practically not a personal car loan. Personal car loans are made with an actual economic institutionlike a financial institution, credit rating union or on-line lending institution.

Let's take a look at each so you can know precisely just how they workand why you do not need one. Ever before.

Some Ideas on Personal Loans Canada You Should Know

Surprised? That's okay. No matter just how excellent your credit report is, you'll still have to pay interest on a lot of personal fundings. There's constantly a cost to pay for borrowing cash. Guaranteed individual financings, on the other hand, have some kind of collateral to Full Article "secure" the finance, their website like a boat, precious jewelry or RVjust among others.

You could additionally take out a secured personal lending using your vehicle as security. Count on us, there's absolutely nothing secure concerning safe fundings.

Some Known Details About Personal Loans Canada

Additionally called adjustable-rate, variable-rate car loans have rate of interest that can transform. You could be attracted in by the deceptively reduced price and tell yourself you'll pay off the financing promptly, however that number can balloonand fast. It's simpler than you believe to get stuck to a higher rates of interest and monthly payments you can not pay for.

And you're the fish holding on a line. An installment funding is a personal financing you repay in taken care of installations in time (generally as soon as a month) till it's paid completely. And do not miss this: You need to repay the original financing quantity prior to you can obtain anything else.

However don't be mistaken: This isn't the same as a credit card. With personal lines of debt, you're paying rate of interest on the loaneven if you pay promptly. This type of funding is super difficult because it makes you assume you're handling your financial debt, when really, it's managing you. Payday advance loan.

This gets us irritated up. Why? Due to the fact that these businesses prey on individuals who can't pay their expenses. Which's simply incorrect. Technically, these are temporary lendings that offer you your income in advance. That may seem enthusiastic when you're in a monetary wreck and need some cash to cover your costs.

The Best Strategy To Use For Personal Loans Canada

Why? Because points get actual unpleasant actual quick when you miss out on a repayment. Those creditors will follow your wonderful granny that cosigned the loan for you. Oh, and you should never guarantee a special info financing for any person else either! Not only can you obtain stuck with a car loan that was never ever indicated to be your own in the first location, but it'll wreck the connection prior to you can claim "pay up." Trust fund us, you don't want to be on either side of this sticky scenario.

Yet all you're actually doing is using brand-new debt to pay off old debt (and extending your financing term). That simply suggests you'll be paying much more with time. Companies understand that toowhich is exactly why so numerous of them provide you debt consolidation lendings. A lower interest rate doesn't get you out of debtyou do.

You just obtain a great debt rating by borrowing moneya lot of cash. Around right here, we call it the "I love debt rating." Why? Since you take on a bunch of financial debt and danger, simply for the "opportunity" of going into also more financial obligation. The system is rigged! Do not fret, there's excellent information: You don't need to play.

Not known Facts About Personal Loans Canada

And it starts with not borrowing anymore cash. ever. This is a good guideline for any kind of financial purchase. Whether you're considering securing an individual loan to cover that kitchen area remodel or your frustrating bank card costs. do not. Taking out debt to spend for points isn't the means to go.

The most effective point you can do for your economic future is leave that buy-now-pay-later way of thinking and claim no to those investing impulses. And if you're taking into consideration an individual financing to cover an emergency situation, we obtain it. Borrowing money to pay for an emergency situation just intensifies the tension and hardship of the situation.

:max_bytes(150000):strip_icc()/Personal-loans-111715-final-3c39d6d214e44604bdc1efca2525d37d.png)

Report this page